Its been a long time since I posted.

And now when I am looking at my screen, I think it is a different monitor.

For my job, I bought a big monitor as I needed to bring work back sometimes.

And boy, is it a good change.

It is much better for my back and eyes.

O, and a new table too, about 2 times bigger.

Feels good too, I have more space and more stuff.

But organized at the same time.

And o, I also bought 2 new watches.

To switch around at work.

They are not expensive, but I got inspiration from youtube channel Urban Gentry.

Ya, I wasn't a big fan 6 months ago.

Well, many changes, but there are still many things to learn and improve.

So, I was thinking about trading again.

This time, I want to follow the flow.

Like silver's decline, I want to be part of that.

Like stocks' rise, I want to be part of it.

Many of the things I learnt and read before, I still remember.

3 portions of bet to allow for flexibility in decision making.

Support and resistance.

Maybe this time, I want to know what I am playing.

I do not really know about currencies.

But I know commodities is doing like shit.

Oil is sinking.

This time, maybe I should just follow the trend.

But still playing by old rules.

The above is silver daily chart.

I drew 2 lines.

I am looking to sell (long term trend).

But I am waiting for the price to rise close to the 2 lines.

Then maybe I will enter.

But I think the amount to bet is very high.

But the idea is something like that.

Saturday, December 26, 2015

Friday, July 31, 2015

Sembcorp, new job, etc

Looking back at my previous post, surprisingly its was May.

Today is the first day of August, and I have gathered many thoughts.

I am 1 month and 2 weeks into my new job.

I got my first pay check, and was glad about the amount I have.

It seems like a pretty good jump, even though it is for 1 mth and 2 weeks.

But it will be a good push for my resources compared to my previous job.

I learnt so many within this 6 weeks, and if I update my resume, it will make it look significantly better.

Hopefully I can continue to hang on to this job, and accumulate more skills and experience.

Few days ago, I also had a few thoughts on shares that I am interested in.

For now, it is quite an favourable period of time.

Many stocks are dipping, but not drastically.

My feelings are that stock market may longer be like the past, where there are very big falls, causing recessions and crisises.

I believe the people and the media are now smarter and knowledgeable, and high lights weakness and problems much faster than before.

So my thoughts are that stocks may be more stable than compared to the past.

But the downside is that it may be harder to buy stocks that are severely under-valued.

4 shares I am monitoring are SMRT, SBS, SPH and Sembcorp Industries.

I might buy Sembcorp Industries next week, maybe on Wednesday.

Why?

Previously when I bought SI, I only bought half of what I wanted.

I like to buy progressively, to give me more peace of mind and better control.

Currently, it is reaching its previous low, which is around 3.2.

I hope to get it at around 3.3.

If it dips further, I might buy around 2, which is the price in 2009 crisis.

The other share that I am enamored with is SPH.

Recently, it purchased some shares of QOO10, which I believe is one of the game changers of retail industry.

Nevertheless, what I like about SPH is that it is starting to change its direction, and invest in many small internet companies.

I fear the internet, as I fear the advance in technology might make me jobless one day.

So to allay the fears, I try to start investing in them now.

I still did not dive in and buy the shares, as the PE ratio is 17.

I think I will just wait and see patiently, as my comfortable PE ratio is 15.

SBS has PE of around 30+, and I prefer SMRT.

I like SMRT because I see it also as the future of transport.

My management friends at the new job all have a view that they might be switching to take public transport in future.

Renewing of COE is crazily expensive, and also it is stressful to drive in the morning.

The government is also aggressively trying to improve the standards of public transport.

But the PE ratio is also quite high, and I will continue to wait and see.

Friday, May 15, 2015

Job

Job gives better return than stocks at this moment in my life.

I have a 20% increase for my next job. Pretty awesome and higher than my expectation (and considering I just got 5% increment 2 months ago).

Can you imagine if it is stocks, it is like saying that my monthly dividends grew by 20%. That is only plausible in a career. Stocks is a very slow and steady game.

Anyhow, for the new job, what matters most is the job scope

(I would have accepted a much lower pay package. But thanks to my outspoken headhunter, I got a good deal).

Nowadays, I see it as investing in myself to become a more valuable person.

So I will grow in value in the working world.

I start the new job in June 2015.

Most importantly, I hope all goes well til then. Although I am excited, I can only take one step at a time.

When my new job starts, I hope I can survive and prove my worth.

If I can at least survive in the job for 2-3 years, the future may be brighter.

It looks quite impressive on a resume.

Though it is a smaller listed local company, I am working under one of the big shots there.

She described the role as a right-hand man, and I am the only analyst under her.

I am hired to analyze all aspects of the company's business in Singapore.

So I really get to learn a lot, at the same time, learn from the best.

The new job will give me a big leap in business and social education.

The reasons why I was chosen for the job is because of my stellar excel skills (vba) and decent presentation ability. Both of which I am grateful for my current company for the opportunities.

For my level of academic achievements (which is crap), it is not easy to find someone impressive to work with and learn from.

This time, my perception of working is different.

I am highly motivated, and put the job above many things.

It is the first time in work where I feel I really want to strive hard.

The previous jobs I had, I do not have the feeling that I am willing to be a dog for the boss. It is because, it is pretty hard to win my respect.

Anyway, I just leave the stock market as it is now.

Currently. it is just dancing up and down, nothing special.

Buffet said, when there is nothing to do, do nothing.

So now, I am focusing my attention on the current main income of my life, which is work.

If there is a substantial collision that happens in the market, I have an amount of cash (not big, it should be viewed as an allocation of your total cash and stocks) ready to be injected into shares.

But for now, my mind is all on the new job.

I hope all goes well til I start my next job, I survive in the new job, I learn and I can do well in it gradually.

Cheers.

I have a 20% increase for my next job. Pretty awesome and higher than my expectation (and considering I just got 5% increment 2 months ago).

Can you imagine if it is stocks, it is like saying that my monthly dividends grew by 20%. That is only plausible in a career. Stocks is a very slow and steady game.

Anyhow, for the new job, what matters most is the job scope

(I would have accepted a much lower pay package. But thanks to my outspoken headhunter, I got a good deal).

Nowadays, I see it as investing in myself to become a more valuable person.

So I will grow in value in the working world.

I start the new job in June 2015.

Most importantly, I hope all goes well til then. Although I am excited, I can only take one step at a time.

When my new job starts, I hope I can survive and prove my worth.

If I can at least survive in the job for 2-3 years, the future may be brighter.

It looks quite impressive on a resume.

Though it is a smaller listed local company, I am working under one of the big shots there.

She described the role as a right-hand man, and I am the only analyst under her.

I am hired to analyze all aspects of the company's business in Singapore.

So I really get to learn a lot, at the same time, learn from the best.

The new job will give me a big leap in business and social education.

The reasons why I was chosen for the job is because of my stellar excel skills (vba) and decent presentation ability. Both of which I am grateful for my current company for the opportunities.

For my level of academic achievements (which is crap), it is not easy to find someone impressive to work with and learn from.

This time, my perception of working is different.

I am highly motivated, and put the job above many things.

It is the first time in work where I feel I really want to strive hard.

The previous jobs I had, I do not have the feeling that I am willing to be a dog for the boss. It is because, it is pretty hard to win my respect.

Anyway, I just leave the stock market as it is now.

Currently. it is just dancing up and down, nothing special.

Buffet said, when there is nothing to do, do nothing.

So now, I am focusing my attention on the current main income of my life, which is work.

If there is a substantial collision that happens in the market, I have an amount of cash (not big, it should be viewed as an allocation of your total cash and stocks) ready to be injected into shares.

But for now, my mind is all on the new job.

I hope all goes well til I start my next job, I survive in the new job, I learn and I can do well in it gradually.

Cheers.

Thursday, March 12, 2015

742 - New love in Stocks, but I still care for Forex

Above 1st chart has some good price actions. Weak bearish pin, followed by bearish engulfing.

But looking at the long term trend (Daily candles), it is bullish. So, I will still leave trading alone.

Monday, February 16, 2015

Stocks - 1 in 1 out

Ex-share

Sold my remaining Creative share.

Why?

Even if Beats audio were to buy them, Beats will wait til their shares drop to very low before coming in.

What about me saying they might win a court battle against the big US companies?

It might not happen so soon. The price might deteriorate much lower, before it actually happens. Even if it eventually happens, it will eventually go down again because ultimately, their way of doing business sucks, no matter how good is their products.

New share

I have been scouting around for quite long.

From my portfolio, I see it as better to acquire 1 more share.

Of course most importantly leaving some money in the war chest.

Some came to my attention. One of it is Ascott REIT.

They have a big stake in Europe. Europe is printing money.

And also, Hong Kong's Li Kai Shing is betting his money on Europe now.

But in the end, I chose not to buy, why?

They are an luxurious business. I prefer thrity and fugal business. Much like my personality. GP hotels which owns the chain of Fragrance hotel is more my taste. But their currently PE ratio is not to my liking (around 19).

Today, I bought Sembcorp Industries.

They are currently at a good price now, due to the oil price plunge.

However, I only bought half of what I wanted.

That is because, the price of oil might cause it to dip further.

It is always better to buy or sell progressively. (What I learnt from Forex)

I might acquire some more in future.

Their dividend payout ratio is ok, at around 3%.

Their Price-Book ratio is around 1.3, which is quite good.

Their PE ratio is around 9.

Their Debt-Equity is also decent, around 0.5 I think.

But the catalyst for me buying: They invested in an Indian company which deals with renewable energy like solar and wind power.

Both factors, India, and renewable energy.

I always wanted to invest in renewable energy, as I think it is an awesome technology.

Secondly, I also like the new India leader, Modi.

India is also another sleeping dragon, with tremendous amount of talented people.

Many of the bosses of MNCs are Indians. Microsoft, DBS.

Actually before I saw the news on Sembcorp's decision on renewable energy, I told myself to not buy anything if I do not like anything at the moment.

I also should like the idea of keeping more cash in my bank account, the same as you prefer your company to be cash rich.

If there is nothing to buy, buy nothing.

Sold my remaining Creative share.

Why?

Even if Beats audio were to buy them, Beats will wait til their shares drop to very low before coming in.

What about me saying they might win a court battle against the big US companies?

It might not happen so soon. The price might deteriorate much lower, before it actually happens. Even if it eventually happens, it will eventually go down again because ultimately, their way of doing business sucks, no matter how good is their products.

New share

I have been scouting around for quite long.

From my portfolio, I see it as better to acquire 1 more share.

Of course most importantly leaving some money in the war chest.

Some came to my attention. One of it is Ascott REIT.

They have a big stake in Europe. Europe is printing money.

And also, Hong Kong's Li Kai Shing is betting his money on Europe now.

But in the end, I chose not to buy, why?

They are an luxurious business. I prefer thrity and fugal business. Much like my personality. GP hotels which owns the chain of Fragrance hotel is more my taste. But their currently PE ratio is not to my liking (around 19).

Today, I bought Sembcorp Industries.

They are currently at a good price now, due to the oil price plunge.

However, I only bought half of what I wanted.

That is because, the price of oil might cause it to dip further.

It is always better to buy or sell progressively. (What I learnt from Forex)

I might acquire some more in future.

Their dividend payout ratio is ok, at around 3%.

Their Price-Book ratio is around 1.3, which is quite good.

Their PE ratio is around 9.

Their Debt-Equity is also decent, around 0.5 I think.

But the catalyst for me buying: They invested in an Indian company which deals with renewable energy like solar and wind power.

Both factors, India, and renewable energy.

I always wanted to invest in renewable energy, as I think it is an awesome technology.

Secondly, I also like the new India leader, Modi.

India is also another sleeping dragon, with tremendous amount of talented people.

Many of the bosses of MNCs are Indians. Microsoft, DBS.

Actually before I saw the news on Sembcorp's decision on renewable energy, I told myself to not buy anything if I do not like anything at the moment.

I also should like the idea of keeping more cash in my bank account, the same as you prefer your company to be cash rich.

If there is nothing to buy, buy nothing.

Friday, January 30, 2015

Stocks - Metrics

PE ratio - below 15

PB ratio - below 2

Debt/Equity ratio - below 0.5

Dividend Yield - around 4%

Most importantly, it is still your feeling and vision about whether the company will perform great in the long run.

PB ratio - below 2

Debt/Equity ratio - below 0.5

Dividend Yield - around 4%

Most importantly, it is still your feeling and vision about whether the company will perform great in the long run.

Stocks - PB ratio

Today, I learnt another new ratio.

It is something that keeps repeating in fool.sg website.

It is the Price to Book ratio, which is the same as Price to Equity ratio.

PE ratio is to gauge if a share is under-valued according to how much it earns.

PB ratio is to see if the stock is under-valued according to how much it possesses.

I wanted to learn the PB ratio, because I want another angle to look at Creative shares.

I cannot grasp a good idea of PE ratio for Creative, as it is making a loss.

But PB ratio can be used for all shares, even those not making a profit.

Creative PB ratio is currently around 0.7, which is good.

As long as it is below a ratio of 1, it is under-valued.

It is like selling an item that is worth 1 dollar for 70 cents.

However, over time, if the company is shit, its loss will diminish its book value.

It is something that keeps repeating in fool.sg website.

It is the Price to Book ratio, which is the same as Price to Equity ratio.

PE ratio is to gauge if a share is under-valued according to how much it earns.

PB ratio is to see if the stock is under-valued according to how much it possesses.

I wanted to learn the PB ratio, because I want another angle to look at Creative shares.

I cannot grasp a good idea of PE ratio for Creative, as it is making a loss.

But PB ratio can be used for all shares, even those not making a profit.

Creative PB ratio is currently around 0.7, which is good.

As long as it is below a ratio of 1, it is under-valued.

It is like selling an item that is worth 1 dollar for 70 cents.

However, over time, if the company is shit, its loss will diminish its book value.

Monday, January 26, 2015

Stocks - Creative volatile day

Today it went down to 1.71 at one point.

Close to the end of the day, there is a rebound to 1.815.

Actually if you look at it technically, it is a bullish pin bar.

If it happen to be on a support zone, and also the overall trend is bullish, then it is a good long trade (according to my Forex strategy).

Anyhow, the dip caused me some panic in office, when I checked my phone.

I am still inexperience with dealing with significant losses.

Many a times in trading and in life, it is imperative that you are able to contain your emotions.

It is a company which I always thought of selling, due to not believing in its business anymore.

Just that recently, I felt there is someone buying big bulks of it.

Not sure about what insider news the buyer has.

Or is the buyer just buying to keep the price up?

Anyway, I placed a sell order at 1.8 for tomorrow, so that I have 1 lot left for my suspicion of a good news.

Selling one lot would also reduce my risk if the price is unable to hold anymore.

It will also settle my nerve a bit.

But hopefully, I am successful in getting rid of one lot tomorrow.

Wednesday, January 21, 2015

742 - new Forex style

Mostly still the same.

Just that I need to counter one problem.

I need to trade more often.

Instead of Daily Candles, I will monitor 4 hourly candles.

Last year, many of my winning trades are actually 4 hourly.

I will still use Daily to view the long term trend.

My steps are still the same.

Just that I need to counter one problem.

I need to trade more often.

Instead of Daily Candles, I will monitor 4 hourly candles.

Last year, many of my winning trades are actually 4 hourly.

I will still use Daily to view the long term trend.

My steps are still the same.

- Price Actions

- Support / Resistance

- Long term trend

Thursday, January 15, 2015

742 - some events, Swiss and Creative

Swiss remove its ceiling from Euro.

The Forex chart went crazy, the Swiss currency shot upwards.

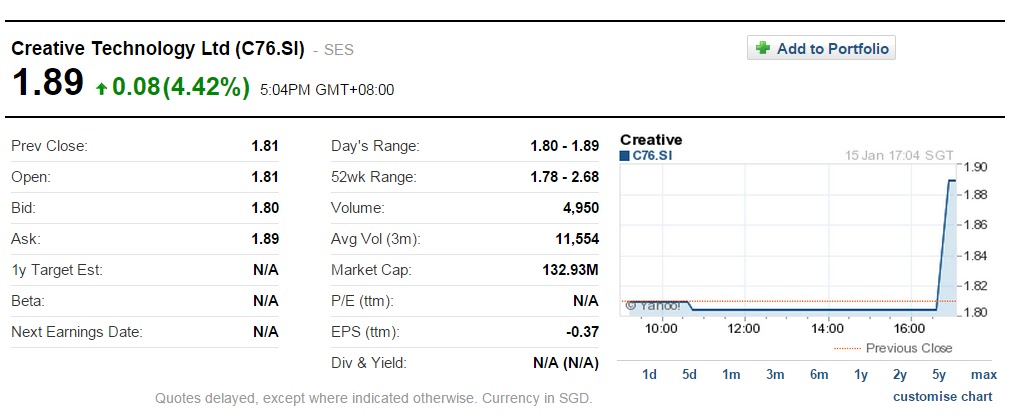

Creative shares shot up again today, over 4%.

And it happened around half hour before the market closed.

I have the urge to sell.

Not because it is a good price to sell, but simply because I no longer like the company.

But good thing for me, I haven't done so yet.

I have been suspecting that someone is buying in bulks.

There are sudden short spikes.

And the person waits until the price to drop back again before making the purchase.

The sellers are starting to get flushed out, leaving only the people that are holding on behind.

Is there some news that might be coming out?

I am hoping something like Beats audio wants to acquire Creative, haha.

The Forex chart went crazy, the Swiss currency shot upwards.

Creative shares shot up again today, over 4%.

And it happened around half hour before the market closed.

I have the urge to sell.

Not because it is a good price to sell, but simply because I no longer like the company.

But good thing for me, I haven't done so yet.

I have been suspecting that someone is buying in bulks.

There are sudden short spikes.

And the person waits until the price to drop back again before making the purchase.

The sellers are starting to get flushed out, leaving only the people that are holding on behind.

Is there some news that might be coming out?

I am hoping something like Beats audio wants to acquire Creative, haha.

Tuesday, January 13, 2015

Stocks - debt

It has puzzled me for some time, about how to understand the financial health of a company.

One ratio you can use is the Debt/Equity ratio, which is also leverage ratio, I suppose.

It might seem straight forward, but not really.

It is not total liabilities divide by total equity.

So how do you get the figure?

Go to balance sheet, go to the liabilities section.

For both of the long term and short term portion, look for descriptions with 'debt' in it.

Total them up, and divide it by total equity.

That is how you get your debt/equity ratio.

Warren Buffet only buys company with debt/equity ratio of 0.5 or below.

In other words, there are 2 times more equity than debt.

Chip Eng Seng has d/e ratio of 0.8.

Sembcorp Marine has d/e ratio of 0.4.

So today, I learnt something more about finance/

An important one, a new dimension of viewing companies.

One ratio you can use is the Debt/Equity ratio, which is also leverage ratio, I suppose.

It might seem straight forward, but not really.

It is not total liabilities divide by total equity.

So how do you get the figure?

Go to balance sheet, go to the liabilities section.

For both of the long term and short term portion, look for descriptions with 'debt' in it.

Total them up, and divide it by total equity.

That is how you get your debt/equity ratio.

Warren Buffet only buys company with debt/equity ratio of 0.5 or below.

In other words, there are 2 times more equity than debt.

Chip Eng Seng has d/e ratio of 0.8.

Sembcorp Marine has d/e ratio of 0.4.

So today, I learnt something more about finance/

An important one, a new dimension of viewing companies.

Monday, January 5, 2015

742 - Crazy movements

Now is the time of some crazy moments again.

GBP/CHF

Rejection at Resistance zone.

Though it did not happen at the peak (1.55).

The overall trend is also bullish.

So the price action and long term trend contradicts.

NZD/USD

Not a very strong signal.

But very obvious support zone.

The overall trend is also a little ambiguous.

It seemed like a bull trend, but it also seem to be bending downwards.

GBP/CHF

Rejection at Resistance zone.

Though it did not happen at the peak (1.55).

The overall trend is also bullish.

So the price action and long term trend contradicts.

NZD/USD

Not a very strong signal.

But very obvious support zone.

The overall trend is also a little ambiguous.

It seemed like a bull trend, but it also seem to be bending downwards.

Subscribe to:

Comments (Atom)