PE ratio - below 15

PB ratio - below 2

Debt/Equity ratio - below 0.5

Dividend Yield - around 4%

Most importantly, it is still your feeling and vision about whether the company will perform great in the long run.

Friday, January 30, 2015

Stocks - PB ratio

Today, I learnt another new ratio.

It is something that keeps repeating in fool.sg website.

It is the Price to Book ratio, which is the same as Price to Equity ratio.

PE ratio is to gauge if a share is under-valued according to how much it earns.

PB ratio is to see if the stock is under-valued according to how much it possesses.

I wanted to learn the PB ratio, because I want another angle to look at Creative shares.

I cannot grasp a good idea of PE ratio for Creative, as it is making a loss.

But PB ratio can be used for all shares, even those not making a profit.

Creative PB ratio is currently around 0.7, which is good.

As long as it is below a ratio of 1, it is under-valued.

It is like selling an item that is worth 1 dollar for 70 cents.

However, over time, if the company is shit, its loss will diminish its book value.

It is something that keeps repeating in fool.sg website.

It is the Price to Book ratio, which is the same as Price to Equity ratio.

PE ratio is to gauge if a share is under-valued according to how much it earns.

PB ratio is to see if the stock is under-valued according to how much it possesses.

I wanted to learn the PB ratio, because I want another angle to look at Creative shares.

I cannot grasp a good idea of PE ratio for Creative, as it is making a loss.

But PB ratio can be used for all shares, even those not making a profit.

Creative PB ratio is currently around 0.7, which is good.

As long as it is below a ratio of 1, it is under-valued.

It is like selling an item that is worth 1 dollar for 70 cents.

However, over time, if the company is shit, its loss will diminish its book value.

Monday, January 26, 2015

Stocks - Creative volatile day

Today it went down to 1.71 at one point.

Close to the end of the day, there is a rebound to 1.815.

Actually if you look at it technically, it is a bullish pin bar.

If it happen to be on a support zone, and also the overall trend is bullish, then it is a good long trade (according to my Forex strategy).

Anyhow, the dip caused me some panic in office, when I checked my phone.

I am still inexperience with dealing with significant losses.

Many a times in trading and in life, it is imperative that you are able to contain your emotions.

It is a company which I always thought of selling, due to not believing in its business anymore.

Just that recently, I felt there is someone buying big bulks of it.

Not sure about what insider news the buyer has.

Or is the buyer just buying to keep the price up?

Anyway, I placed a sell order at 1.8 for tomorrow, so that I have 1 lot left for my suspicion of a good news.

Selling one lot would also reduce my risk if the price is unable to hold anymore.

It will also settle my nerve a bit.

But hopefully, I am successful in getting rid of one lot tomorrow.

Wednesday, January 21, 2015

742 - new Forex style

Mostly still the same.

Just that I need to counter one problem.

I need to trade more often.

Instead of Daily Candles, I will monitor 4 hourly candles.

Last year, many of my winning trades are actually 4 hourly.

I will still use Daily to view the long term trend.

My steps are still the same.

Just that I need to counter one problem.

I need to trade more often.

Instead of Daily Candles, I will monitor 4 hourly candles.

Last year, many of my winning trades are actually 4 hourly.

I will still use Daily to view the long term trend.

My steps are still the same.

- Price Actions

- Support / Resistance

- Long term trend

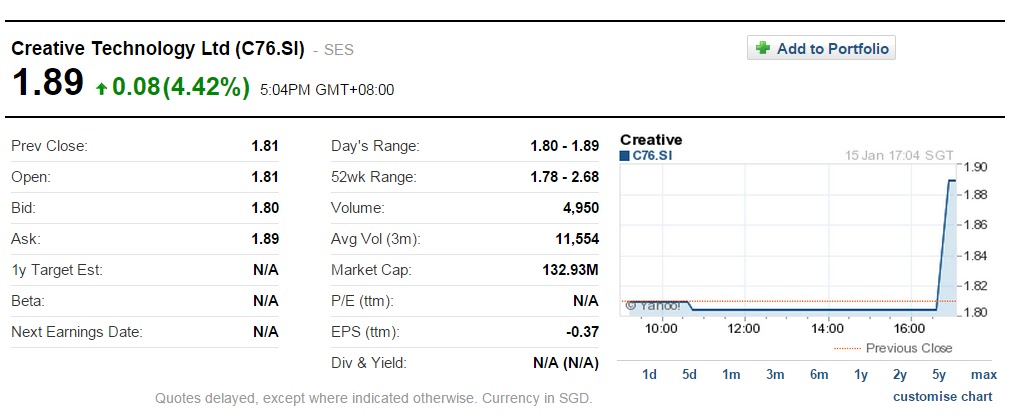

Thursday, January 15, 2015

742 - some events, Swiss and Creative

Swiss remove its ceiling from Euro.

The Forex chart went crazy, the Swiss currency shot upwards.

Creative shares shot up again today, over 4%.

And it happened around half hour before the market closed.

I have the urge to sell.

Not because it is a good price to sell, but simply because I no longer like the company.

But good thing for me, I haven't done so yet.

I have been suspecting that someone is buying in bulks.

There are sudden short spikes.

And the person waits until the price to drop back again before making the purchase.

The sellers are starting to get flushed out, leaving only the people that are holding on behind.

Is there some news that might be coming out?

I am hoping something like Beats audio wants to acquire Creative, haha.

The Forex chart went crazy, the Swiss currency shot upwards.

Creative shares shot up again today, over 4%.

And it happened around half hour before the market closed.

I have the urge to sell.

Not because it is a good price to sell, but simply because I no longer like the company.

But good thing for me, I haven't done so yet.

I have been suspecting that someone is buying in bulks.

There are sudden short spikes.

And the person waits until the price to drop back again before making the purchase.

The sellers are starting to get flushed out, leaving only the people that are holding on behind.

Is there some news that might be coming out?

I am hoping something like Beats audio wants to acquire Creative, haha.

Tuesday, January 13, 2015

Stocks - debt

It has puzzled me for some time, about how to understand the financial health of a company.

One ratio you can use is the Debt/Equity ratio, which is also leverage ratio, I suppose.

It might seem straight forward, but not really.

It is not total liabilities divide by total equity.

So how do you get the figure?

Go to balance sheet, go to the liabilities section.

For both of the long term and short term portion, look for descriptions with 'debt' in it.

Total them up, and divide it by total equity.

That is how you get your debt/equity ratio.

Warren Buffet only buys company with debt/equity ratio of 0.5 or below.

In other words, there are 2 times more equity than debt.

Chip Eng Seng has d/e ratio of 0.8.

Sembcorp Marine has d/e ratio of 0.4.

So today, I learnt something more about finance/

An important one, a new dimension of viewing companies.

One ratio you can use is the Debt/Equity ratio, which is also leverage ratio, I suppose.

It might seem straight forward, but not really.

It is not total liabilities divide by total equity.

So how do you get the figure?

Go to balance sheet, go to the liabilities section.

For both of the long term and short term portion, look for descriptions with 'debt' in it.

Total them up, and divide it by total equity.

That is how you get your debt/equity ratio.

Warren Buffet only buys company with debt/equity ratio of 0.5 or below.

In other words, there are 2 times more equity than debt.

Chip Eng Seng has d/e ratio of 0.8.

Sembcorp Marine has d/e ratio of 0.4.

So today, I learnt something more about finance/

An important one, a new dimension of viewing companies.

Monday, January 5, 2015

742 - Crazy movements

Now is the time of some crazy moments again.

GBP/CHF

Rejection at Resistance zone.

Though it did not happen at the peak (1.55).

The overall trend is also bullish.

So the price action and long term trend contradicts.

NZD/USD

Not a very strong signal.

But very obvious support zone.

The overall trend is also a little ambiguous.

It seemed like a bull trend, but it also seem to be bending downwards.

GBP/CHF

Rejection at Resistance zone.

Though it did not happen at the peak (1.55).

The overall trend is also bullish.

So the price action and long term trend contradicts.

NZD/USD

Not a very strong signal.

But very obvious support zone.

The overall trend is also a little ambiguous.

It seemed like a bull trend, but it also seem to be bending downwards.

Subscribe to:

Comments (Atom)