Bought another share of Google.

Did not really think long about it, took less than one minute.

Not sure about the reason for the drop in price, it fell around 6% when I opened my Ameritrade account.

But for some time, I wanted to add more Google holdings.

They are going to be here for a long time.

And their Google phone seem to be great, especially the new budget one.

The new phone is a very fresh idea, great camera great price, just less powerful hardware.

Suitable for someone like me who does not game.

Also, they will likely not be affected by the trade war. Cause China shuts them out anyway.

It might even help them, if Huawei phone does not have Android.

Who wants to buy a phone without youtube and gmail! Maybe few, real few.

But I have low funds in my Ameritrade account now, close to USD $2k.

And I need funds now for my Singapore shares.

Well, I guess it is better to buy great companies at decent prices.

Progressively.

Rather than keep waiting them to reach a certain price you want.

Monday, June 3, 2019

Sunday, June 2, 2019

Eating more DBS

This week, I saw a respectable Singapore investing blogger liquidated 50% of his portfolio.

He has close to $1 mil of shares. So his warchest is now around $500k.

That is also the same person that gave me confidence to further invest in First Reit.

And he liquidated First Reit away too.

I thought to myself, should I also free up some funds to prepare for uncertain future?

The uncertain future that is the long speculated recession after 10 years of bull run?

He is not the only one talking about having a sizeable amount of cash.

'Financial education', a channel on youtube also talked about having 10-30% cash on standby.

I thought maybe I won't.

I thought maybe I won't.

I am a investor, and I recalled Warren Buffet's words.

His favourite holding period is forever.

There may be some stocks that I like more than others.

But I am not a speculator.

I do not sell shares, just because I think there will be good opportunities in coming months.

I do not sell shares, just because I think there will be good opportunities in coming months.

Unless the stock is scaring me that it is heading in a seriously wrong direction.

Some of the shares I hold may not be performing well, or will not perform well in coming years.

But I am here for the long term.

But I am here for the long term.

I also asked myself how do I invest at the moment.

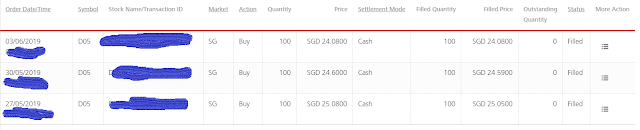

It is quite exciting in recent times, and DBS has fallen back to the level of $24-25.

I bought 2 times last week.

I will buy again when it reaches a level of dividend yield of slightly more than 5%.

And another time when it hits somewhere close to $23.

And so on when $20, and then $15.

I also pondered, what about my logic of leaving some cash when recession hits?

But I am leaning more towards buying more, even though we are not in recession yet.

But I am leaning more towards buying more, even though we are not in recession yet.

Reason is because, if I do not buy now, when am I going to hit $100k of shares?

I am not going all in at the moment, but since now the price is decent, I will progressively purchase more to get closer to the next milestone.

Moreover, I also fear that my salary keeps coming in, and yet I am not converting it into more investments.

So even if I buy 2 or 3 times in coming weeks, I might still have incoming salary and bonus that can bump my warchest back to around $20k.

My current concern is more about investing when there is reasonable opportunities, rather than having enough bullets when crisis comes.

Subscribe to:

Comments (Atom)