Unwilling pulled the trigger on Google

Sold 1 share

Wanted to unlock some cash for Singapore Stocks Warchest

And also because Google share price broke record high today

Also sold half of my Nvidia holdings, which is 6 shares.

Initially wanted to wait for my target price of 210

But doing a calculation, it is only extra 12 bucks.

The other 6 shares, I might see how it goes when is on the way to the next support level (around 250).

Currently I have US$5k freed up

Total account including cash is now @ US$34 k

If it hit 35k, then it will be special for me

as it should be around Singapore 50k.

but it might drop below it quickly when crisis hits

or continue rising, and I still have stocks inside to benefit from it

But my current aim now is to lock in some profit and have some cash first

Monday, October 28, 2019

Saturday, October 26, 2019

Unlocking US Stock Funds

My warchest is becoming thinner

Looking to unlock some funds from my US Stock account.

Might see if I can get S$10k from there for Singapore Shares warchest

Had been thinking about how to unlock last night

some ideas:

if there is really a recession next year

at least managed to lock in to some profit on the high

before value of shares decline

and use the money to pump into Singapore dividend shares

when they are cheap

Nvidia is a good candidate to sell

as its PE is high at ~45

also due to bitcoin slowing

their revenue is hit

they are also close to their next resistant level @ 219

I was thinking of exiting @ 210

Looking to unlock some funds from my US Stock account.

Might see if I can get S$10k from there for Singapore Shares warchest

Had been thinking about how to unlock last night

some ideas:

- those with very high PE ratio

- those already close to a resistance level

if there is really a recession next year

at least managed to lock in to some profit on the high

before value of shares decline

and use the money to pump into Singapore dividend shares

when they are cheap

Nvidia is a good candidate to sell

as its PE is high at ~45

also due to bitcoin slowing

their revenue is hit

they are also close to their next resistant level @ 219

I was thinking of exiting @ 210

Friday, October 25, 2019

Luv Hong Kong

Bought 500 Hong Kong Land again today

Was thinking the righting in HK is getting less ferocious

And Trump may make up to China slightly

Also I still need to invest sometimes

Rather than always waiting for a crisis

My war chest now is not that good

Less than 20k

But there are still some things I can mobilize

Like selling silver when the price rises again

There is still my USD trading account

also the option to borrow from bank using loan by stocks

Recently Tesla popped

Got the chance to see when stocks rise, they really do so quickly

My trading is also not going well

but I may still continue by adding an additional step

which is to watch the action around the support

before joining the train

Was thinking the righting in HK is getting less ferocious

And Trump may make up to China slightly

Also I still need to invest sometimes

Rather than always waiting for a crisis

My war chest now is not that good

Less than 20k

But there are still some things I can mobilize

Like selling silver when the price rises again

There is still my USD trading account

also the option to borrow from bank using loan by stocks

Recently Tesla popped

Got the chance to see when stocks rise, they really do so quickly

My trading is also not going well

but I may still continue by adding an additional step

which is to watch the action around the support

before joining the train

Monday, October 21, 2019

INFY buy

Also accidentally closed the Tesla trade, by buying 5 shares of Tesla.

What happened was because I put a Limit order at 267.

But Limit order will buy the share if it is a better price.

In other words, 267 or below.

Sunday, October 20, 2019

Friday, October 18, 2019

Thursday, October 17, 2019

Bought Tyson

Stock scanning:

How is the angle of 150 & 200 SMA line?

If it is too flat, I skip it

When the angle is steeper

it suggest the current trend is strong

next I see if there is any retracement

but how much of a retracement is considered good?

when it is near a resistant/support line

when it is near a resistant/support line

or even close to any sma line

next is to see if i can have low cost

and high return

best is the stop loss i want to see is very close to the current price

then i can risk less, and win bigger

Enter the above

the resistance is quite good, has been test 2 times

win-loss ratio of 3 times

Tuesday, October 15, 2019

Saturday, October 12, 2019

Weekend Stock Charts Absorption

Some simple thoughts :

look at the overall trend, using 150 and 200 SMA

look for those sloping up or downwards

nevermind about those that are more straight

next, is there a retracement?

like upward trend, but price is going downwards to hit 150 or 200 SMA

or hitting resistant/support line

these are the opportunities

set stop loss slightly away from 150 or 200 SMA

allowing for some buffer

try to aim for smaller gap between current price and stop loss

so that win-loss ratio is higher

so when to take the win?

use resistant/support line

set limit slightly below resistance line. vice versa

win-loss ratio should not be less than 1

in other words, if you risk 100, your potential win have to be more than that

if ever you feel lost when trading, just remember the main logic:

you just want to ride on the trend, by entering when there is a retracement

look at the overall trend, using 150 and 200 SMA

look for those sloping up or downwards

nevermind about those that are more straight

next, is there a retracement?

like upward trend, but price is going downwards to hit 150 or 200 SMA

or hitting resistant/support line

these are the opportunities

set stop loss slightly away from 150 or 200 SMA

allowing for some buffer

try to aim for smaller gap between current price and stop loss

so that win-loss ratio is higher

so when to take the win?

use resistant/support line

set limit slightly below resistance line. vice versa

win-loss ratio should not be less than 1

in other words, if you risk 100, your potential win have to be more than that

if ever you feel lost when trading, just remember the main logic:

you just want to ride on the trend, by entering when there is a retracement

Wednesday, October 9, 2019

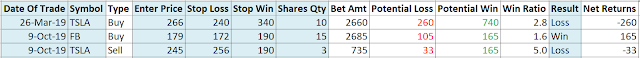

Traded Tesla

Anyway I sold 3 Tesla, without knowing that it is deducting from my current holdings

So currently, I hold 17 Tesla Shares.

So currently, I hold 17 Tesla Shares.

Tesla also a candidate

From the previous posts that I wrote about trading

Tesla also seems to be a good candidate to short

Looking at the green and blue long term lines

It is quite obvious a downward trend

and currently it is retracing upwards.

it might go down again to the 175 level

Tesla also seems to be a good candidate to short

Looking at the green and blue long term lines

It is quite obvious a downward trend

and currently it is retracing upwards.

it might go down again to the 175 level

Update from the previous post

Sold 5 shares of FB @ USD179.5.

The reason is because I am on negative funds.

Should have checked how much is the bet before placing the order.

Now currently trading 15 shares of FB.

The reason is because I am on negative funds.

Should have checked how much is the bet before placing the order.

Now currently trading 15 shares of FB.

Trading again

Previous trade, I lost money with Tesla.

After watching Adam Khoo's video, I added another tool for analysis.

Using Simple Moving Averages of 50, 150 and 200 time period.

My logic for opportunity is to look at whether is it an uptrend or down trend first.

How? Is 150 and 200 SMA sloping upwards?

Next, look at the price now, is there a retracement from the upward trend?

(Sometimes the 150 and 200 SMA are a form of resistance)

(Sometimes the 150 and 200 SMA are a form of resistance)

If so, it is a buying opportunity.

I am risking USD 138 for this trade.

Placed the Stop Loss below the lowest point on 2 Oct 2019.

Some words from AK along the lines of "we are not trying to predict the market. We are just trying to follow it. When it is going up, we follow it. When it is going down, we follow it."

Some words from AK along the lines of "we are not trying to predict the market. We are just trying to follow it. When it is going up, we follow it. When it is going down, we follow it."

Subscribe to:

Comments (Atom)