cause I wanted to buy DBS shares

With share financing

But both Poems and OCBC are taking very long to open account

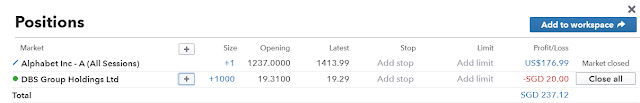

The way to hedge it to take a position with CFD

using my IG account, which was there all along

It really eases the anxiety,

when I am not sure when I can get my new accounts

and also fearful that the share price will go up

currently, DBS shares is below 20

it is a great price, as it has dividend yield more than 6%

and that is based on the old dividends

moving forwards, dividends may increase to 1.33

which will bring dividend yield to 7.3%

Later in the day, Singapore government will announce another stimulus package

Called Fortitude

Not sure how much will it cause DBS to rise

I am hoping to buy another 1000 DBS shares on CFD

as I hope to own 5k DBS shares coming out of the crisis.

Coincidentally, today is supposed to be the day we receive DBS dividends

Hopefully I am getting 2k if I am not wrong

Once I see it in my account, I might pump that money into IG again

and buy the other 1000 DBS CFD

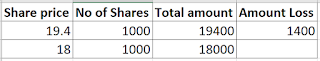

Also did some stress testing on the CFD positions

The 1000 DBS shares that I buy,

if it falls to $18, it will incur a loss of $1400.

And good thing is it will not be margin called yet.

Maybe it is a good thing that I only have limited funds in IG account

It can be an auto stop loss

But to me, it may not be very likely

The price seems quite stable now

The SNP 500 is starting to breaking the resistance zone of 2975

So what does this have to do with the share financing account?

When the share financing account is set up, I will buy 500 shares each in Poems and OCBC

and every time I buy 500 shares, I will sell 500 shares in IG

So in a way, I am using the CFD positions as a hedge in case the price rise in future.