Something I learnt from reading Nial Fuller's website today, Price Action strategies are mainly used for contrary trades. Meaning the opposite of breakouts.

I think that is what the Naked Forex book taught as well. The logic is simple. Breakout happen a lot less often than contrary trades. Price tend to bounce a few times away from support/resistance lines first before finally breaking through.

Thursday, October 31, 2013

Wednesday, October 30, 2013

802.52 - Big Shadow forming at SGD

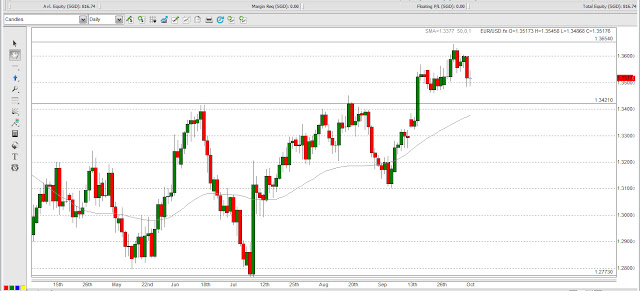

Some activities going on around the resistance zone.

I started following SGD because I can relate to it, as it is my country. I recently read a report from Singapore Business Review that on the long term, SGD will strengthen against the USD. But for now, and for awhile, I believe USD will fall due to the recent rejection to tapering of the QE.

The below resistance line is not obvious because I drew it from looking at Weekly Candles. A Big Shadow seems to be forming on the Daily chart, suggesting that the trend will continue to going downwards.

Another thing I read about today is that the Australia Central bank feels that its currency is over-valued. They might be taking action to pull the value of their currency down against the USD, which is welcomed by their exporters. So on the long run, you might be seeing AUD finally falling after a long period of rise.

Tuesday, October 29, 2013

802.52 - Nial Fuller

I have been reading the posts made by Nial Fuller in office today.

They say if you want a shortcut in gaining trading experience, you can practise by looking at past charts. But I think the even better way is to read all the past posts of Nial Fuller, which he frequently comments about commodity and currency price actions.

Nial has been extremely generous about his information, even though I never transfer him a single cent. It is all free in the below link.

http://www.learntotradethemarket.com/forex-trading-commentary

The reason why reading all his past posts is much better than scanning through past data is because you are able to get into the mind of an accomplished trader. There are many things I learnt today, and I will try to put down whatever I can recall below.

They say if you want a shortcut in gaining trading experience, you can practise by looking at past charts. But I think the even better way is to read all the past posts of Nial Fuller, which he frequently comments about commodity and currency price actions.

Nial has been extremely generous about his information, even though I never transfer him a single cent. It is all free in the below link.

http://www.learntotradethemarket.com/forex-trading-commentary

The reason why reading all his past posts is much better than scanning through past data is because you are able to get into the mind of an accomplished trader. There are many things I learnt today, and I will try to put down whatever I can recall below.

- The wealthiest traders in the world may just have 2-3 trades in a month, and that is good enough to grow their money every month.

- I think Nial only maintain around $50,000 into his account. You do not need so much because you can use leverage.

- Nial likes simplicity in life and in trading. He only has a ultrabook and not multiple monitors and powerful processors.

Saturday, October 26, 2013

802.52 - New trading idea

It is not exactly new, just some more ideas how I can go about my trading.

I have not been getting frequent trades for a long long time. It is also good in a way it can test my patience. I want to be sure of what I am doing before I dive into it.

http://www.adam-khoo.com/1315/making-a-fortune-short-selling-gold-and-it-is-just-the-beginning/

Below is an article by Adam Khoo, which gave me the idea. He is one of my favorite authors, because of his insights and also the way he writes his books. He don't use fancy languages or literature. That is one thing that is missing from many books. His books are as easy as reading a primary school book, and because of that, you can absorb a lot more knowledge from it faster.

Back to the topic, the article demonstrates clearly that you can easily combine fundamental understanding with technical methods. What I can do is I can be a frequent news reader, and know what is the major thing that is going on currently.

For example, recently, the Fed just killed peoples' expectation again of a QE tapering. So from that, I know that I should be seeing the price of USD depreciating among other currencies for a few weeks.

Once I know a major fundamental movement, the next step is to use technical analysis to get in the trade. Basically, the idea to get into the trade is when there is a slight dip while expecting a surge, vice versa.

Adam Khoo's article is a very good read about how he does it. And in the next few weeks, I will be looking to see if there is a good time to leap into the train of the fundamental movement.

I have not been getting frequent trades for a long long time. It is also good in a way it can test my patience. I want to be sure of what I am doing before I dive into it.

http://www.adam-khoo.com/1315/making-a-fortune-short-selling-gold-and-it-is-just-the-beginning/

Below is an article by Adam Khoo, which gave me the idea. He is one of my favorite authors, because of his insights and also the way he writes his books. He don't use fancy languages or literature. That is one thing that is missing from many books. His books are as easy as reading a primary school book, and because of that, you can absorb a lot more knowledge from it faster.

Back to the topic, the article demonstrates clearly that you can easily combine fundamental understanding with technical methods. What I can do is I can be a frequent news reader, and know what is the major thing that is going on currently.

For example, recently, the Fed just killed peoples' expectation again of a QE tapering. So from that, I know that I should be seeing the price of USD depreciating among other currencies for a few weeks.

Once I know a major fundamental movement, the next step is to use technical analysis to get in the trade. Basically, the idea to get into the trade is when there is a slight dip while expecting a surge, vice versa.

Adam Khoo's article is a very good read about how he does it. And in the next few weeks, I will be looking to see if there is a good time to leap into the train of the fundamental movement.

Monday, October 21, 2013

802.52 - Price actions

At the moment, I will be focusing more on Price Actions.

I am following more closely to the Naked Forex book (Price Action) rather than the Kathy Lien's book. For Price Action trading, I will be looking at different currencies at a time rather than focusing and getting familiar with one. I learnt that from Nial Fuller, as he seem to be reading stories of different currencies and writing reports about each of them frequently.

But there are still many things that I learnt from Kathy which I can also apply. Like the Inside Bars trading and also the Double Zeros. For Inside Bars trading, I think it is what Nial Fuller refer to as 'Fakey'. For Double Zeros, it opened my eyes to charts. It helped me see what happens when price reaches 2 zeros behind, and I also managed to draw some of the resistance lines on them.

From reading these 2 great books, it emphasized and also made me see the important of horizontal lines, what are the resistance and support lines. I guess most traders are not able to make money without them.

I hope there are opportunities soon for me to start making money from Price Action soon. My account is dwindling for too long.

Friday, October 18, 2013

802... - GFT down, wah lua eh

I finished reading the chapter of what most hedge fund managers do.

I was actually quite looking forward to the chapter, as her experiences can give me an insight what the professional does. After reading it, I find that it is actually quite similar to what my army friend said, who is also a trader doing the Philippines currency.

Anyway, the chapter gave me a better idea how to do things.

I was actually quite looking forward to the chapter, as her experiences can give me an insight what the professional does. After reading it, I find that it is actually quite similar to what my army friend said, who is also a trader doing the Philippines currency.

Anyway, the chapter gave me a better idea how to do things.

- Specialize in one or few currencies. Professionals rarely use the same strategy for all currencies.

- Study your specialized currency. There are 2 types of trading, which is trend and range trading. You have to determine the currency is more suitable for which. But most hedge fund managers are trend traders.

- Write down your rules and back test your strategy.

- You should set a limit how much to lose in a single trade. And also, you should also set a limit how much you can lose in your account. Lets say you already lost 20% of your account, you should consider if you should discard your strategy. It is possible that the trading environment has evolved into something different from what you back tested.

I can't do anything at the moment, because GFT is down. Can't use the online Dealbook or Dealbook 360. Crap. Hope it does not happen often.

Saturday, October 12, 2013

808.76 - Zero faders

One of the new insights that I learnt from the Kathy Lien's book is regarding the zeros fader. Prices tend to have big actions whenever the price hit figures with many zeros behind.

This is because many big players like the bank will execute an order that is not too precise, like 1.6783, etc. As humans, when we think of a number, we are usually more brief, and will execute an order more like 1.6000, etc. This represents good trading opportunities, if we take note of these ranges. Figures that we can take note of is figures with at least 2 zeros behind, for example 1.6700.

The above Weekly chart is a fascinating example of what happens when prices hit 3 zeros.

808.76 - what's wrong

I lost the bet I put in previously. Actually I made a mistake regarding the overall trend for the Daily chart. The overall trend should be bullish. One of the dicators is that it is above the 50 SMA line. So I should be going bullish instead of bearish.

Another thing is that when looking at the Hourly chart after knowing the above trend, there are 2 ways to enter the market. One is by breakout, another is by retracement from resistance line. The latter is better as it happens more often.

Thursday, October 10, 2013

816.74 - coming up with a system

Sometimes the more you read, the more information you take in, the more complicating it gets.

So today I stopped for awhile. And before I continue reading, I want to try out and iron out some of the important and basic things I learnt.

In the technical strategies chapter, on the very first topic, it taught something like a multi-period analyzing. It basically means that before you analyze the hourly chart, you take a look at the daily chart to gain an idea of the big picture. And from the big picture, you determine if it is good to go long or short.

After that, you move on to the hourly chart and look for entrancement to get in. It is pretty similar to what I did last time, but this time, I will be using resistant lines.

Currently, to keep things simple, I only have the daily and hourly chart. If I have even more time for day trading, I can even open a 15 min chart. But for now, I will just use the former 2.

The first thing I do for both charts is to draw out major resistant lines. After that, I look at the daily chart first to determine to go long or short. This can be determined when you see the trend being rejected by a resistant zone repeatedly.

After determining to go long or short, I use the hourly chart to help me choose a time to enter. This time, if I want to go short, I will look for the trend to retrace upwards to a resistant zone before I enter the trade. I will be hoping that the resistant zone rejects the trend and continues downward, contrary to a breakout.

So below are the steps

Below is the Daily chart, followed by the Hourly chart of EUR/USD

So today I stopped for awhile. And before I continue reading, I want to try out and iron out some of the important and basic things I learnt.

In the technical strategies chapter, on the very first topic, it taught something like a multi-period analyzing. It basically means that before you analyze the hourly chart, you take a look at the daily chart to gain an idea of the big picture. And from the big picture, you determine if it is good to go long or short.

After that, you move on to the hourly chart and look for entrancement to get in. It is pretty similar to what I did last time, but this time, I will be using resistant lines.

Currently, to keep things simple, I only have the daily and hourly chart. If I have even more time for day trading, I can even open a 15 min chart. But for now, I will just use the former 2.

The first thing I do for both charts is to draw out major resistant lines. After that, I look at the daily chart first to determine to go long or short. This can be determined when you see the trend being rejected by a resistant zone repeatedly.

After determining to go long or short, I use the hourly chart to help me choose a time to enter. This time, if I want to go short, I will look for the trend to retrace upwards to a resistant zone before I enter the trade. I will be hoping that the resistant zone rejects the trend and continues downward, contrary to a breakout.

So below are the steps

- Draw major resistant lines on both Daily and Hourly chart

- Look at the Daily chart to know to go long or short

- Look at the Hourly chart to find a right time to get in

Below is the Daily chart, followed by the Hourly chart of EUR/USD

Tuesday, October 8, 2013

816.74 - when hanging out with friends

Many posts ago, I wrote something about socializing.

Today, I digested the main point of what I was trying to say, in a simple sentence.

Basically, it is 'Don't talk when you don't feel like talking'.

I realized that it filters out many awkward or unnatural things that I might say. Sometimes I am happier and calmer when I just keep quiet, to rest, to listen or just to do my own stuff.

I will more naturally build up the momentum to socialize when the time is right. And it is also closer to being myself, which is the sole theory I follow.

Today, I digested the main point of what I was trying to say, in a simple sentence.

Basically, it is 'Don't talk when you don't feel like talking'.

I realized that it filters out many awkward or unnatural things that I might say. Sometimes I am happier and calmer when I just keep quiet, to rest, to listen or just to do my own stuff.

I will more naturally build up the momentum to socialize when the time is right. And it is also closer to being myself, which is the sole theory I follow.

816.74 - nothing happened

Pull out my bet from last night. The Big Shadow did not proceed downwards, and it seems to be testing the resistant line again.

Monday, October 7, 2013

816.74 - New platform, and new bet

Today I went down to the GFT office in Robinsons Center building in the CBD. I really like the company, and also the friendly support they provide. I did not even bother to compare their spread rates as they made me feel so they are so trust-worthy.

Kathy Lien also used to work there before, and I guess some of the things that I am using now may have some way or another been contributed by her. Reading through the book halfway, I have to say it is an awesome book, compared to some of the other expensive Forex book I got.

Anyway today I ended up with another new trading platform. I am trying to get used to it, and it is pretty good. The software I am using is Dealbook 360, the in-house software of GFT. Previously I was using their web-based platoform.

Previous few posts, I talked about the Big Shadow forming in GBP/USD. I missed it, but saw another Big Shadow in EUR/USD. So this time I want to be in the game. Hopefully it turns out well. This is my first bet since so long ago. I am ready to go again, at the same time swallowing more knowledge from reading.

Kathy Lien also used to work there before, and I guess some of the things that I am using now may have some way or another been contributed by her. Reading through the book halfway, I have to say it is an awesome book, compared to some of the other expensive Forex book I got.

Anyway today I ended up with another new trading platform. I am trying to get used to it, and it is pretty good. The software I am using is Dealbook 360, the in-house software of GFT. Previously I was using their web-based platoform.

Previous few posts, I talked about the Big Shadow forming in GBP/USD. I missed it, but saw another Big Shadow in EUR/USD. So this time I want to be in the game. Hopefully it turns out well. This is my first bet since so long ago. I am ready to go again, at the same time swallowing more knowledge from reading.

Saturday, October 5, 2013

Equity:816.74 - About hair, really

For a long time, I have always admired and wondered why some men hair quality is better than others. I am not born with great hair quality, as evident in my family. My mother has quite little and thin hair, my father has thick and abundant of hair.

I am like my father, the better of the 2. It is just that even though it is thick and plenty, the quality is not nice. After much observation, consultation with friends and experimentation, I think I got it.

Below is my tad tedious routine, but it is still little time spent compared to the amount of time I will be spending outside and looking better.

The reason why there are so many shampooing is because we use hair wax, especially Gatsby. It is hard to wash off, and washing your hair clean is important as it keeps your hair lighter and easier to style. Yesterday was my friend's wedding, and I washed my hair 3 times in a day due to a break in the middle of the day. But it still feels ok, or in fact better. Probably due to the fact that my hair is thicker and stronger. Frequent washing might not be good for people with thin hair.

I also bought Argan oil without Alcohol. People in the past call it liquid gold, it is basically an oil from a tree from some country. The feel of the oil is quite magical. It feels oily, yet it gets absorbed quickly, and you don't feel your hands are dirty without washing your hands. It is supposedly also good for your skin. The one I purchased is called '100% Monaco Argan oil', for around S$20. I press 3 drops of it for each application.

Also use a Gatsby hair wax. It is cheaper than some other brands like Sebastian clay, which cost around 3 times more. Sebastian is also not easily found anywhere, and the price stops me from trying it. I also tried some other Korean wax that is eager to compete with the Japanese company, but it simply does not hold as well. You have to trust Takuya Kimura.

Regarding how much wax I apply, I use my third finger tip and scoop up enough to cover the tip with a little thickness. Then I rub it into both palms until a little warm and apply it to whole hair. I heard its easily absorbed when its a little warm. Learnt it from a video in YouTube by a sissy guy, and its good knowledge.

Of all their wax, my favorite is the purple one. It is suitable for my hair length. I also have the pink one, whenever my hair got cut too short.

I am like my father, the better of the 2. It is just that even though it is thick and plenty, the quality is not nice. After much observation, consultation with friends and experimentation, I think I got it.

Below is my tad tedious routine, but it is still little time spent compared to the amount of time I will be spending outside and looking better.

- After work/outing, shampoo hair

- Apply Argan oil

-------------------------------------------------

- Before going out, shampoo hair

- Use conditioner

- Apply Gatbsy

- Hair spray to hold it

The reason why there are so many shampooing is because we use hair wax, especially Gatsby. It is hard to wash off, and washing your hair clean is important as it keeps your hair lighter and easier to style. Yesterday was my friend's wedding, and I washed my hair 3 times in a day due to a break in the middle of the day. But it still feels ok, or in fact better. Probably due to the fact that my hair is thicker and stronger. Frequent washing might not be good for people with thin hair.

I also bought Argan oil without Alcohol. People in the past call it liquid gold, it is basically an oil from a tree from some country. The feel of the oil is quite magical. It feels oily, yet it gets absorbed quickly, and you don't feel your hands are dirty without washing your hands. It is supposedly also good for your skin. The one I purchased is called '100% Monaco Argan oil', for around S$20. I press 3 drops of it for each application.

Also use a Gatsby hair wax. It is cheaper than some other brands like Sebastian clay, which cost around 3 times more. Sebastian is also not easily found anywhere, and the price stops me from trying it. I also tried some other Korean wax that is eager to compete with the Japanese company, but it simply does not hold as well. You have to trust Takuya Kimura.

Regarding how much wax I apply, I use my third finger tip and scoop up enough to cover the tip with a little thickness. Then I rub it into both palms until a little warm and apply it to whole hair. I heard its easily absorbed when its a little warm. Learnt it from a video in YouTube by a sissy guy, and its good knowledge.

Of all their wax, my favorite is the purple one. It is suitable for my hair length. I also have the pink one, whenever my hair got cut too short.

Friday, October 4, 2013

Thursday, October 3, 2013

Equity:816.74 - MT4 and Big Shadow on GBP?

I will be switching from using Dealbook to MT4. Just need to prepare some documents in office tmr and mail it to GFT Singapore. The reason for the switch is because it is good that I learn to use a more professional interface, and also I can save my settings for the next time I turn on my computer.

When I use Dealbook, which is a software using the internet, I always have to redraw the resistant lines again whenever I turn on my computer.

Anyway, it seems like GBP/USD might have a Big Shadow developing on the resistant line. Will see what happens tmr. Nightz!

When I use Dealbook, which is a software using the internet, I always have to redraw the resistant lines again whenever I turn on my computer.

Anyway, it seems like GBP/USD might have a Big Shadow developing on the resistant line. Will see what happens tmr. Nightz!

Tuesday, October 1, 2013

Equity:816.74 - New idea to trade from Kathy's book

Some of the methods that are taught are surprising close to what I did last time.

Anyway, today I learnt a simple method of trend trading.

Anyway, today I learnt a simple method of trend trading.

- Use Daily chart and see the overall trend

- Then switch to Hourly chart and look for a retracement to enter

- This is done by seeing the price hitting a resistant zone and bouncing away again

And the above forms a confluence between a major trend, and a resistant level.

Subscribe to:

Comments (Atom)

.jpg)