I had an opportunity to buy when they were much cheaper, but did not.

Thursday, December 24, 2020

Initiated small China position

I had an opportunity to buy when they were much cheaper, but did not.

CFD interest rate

I am unsure how much is the interest rate of CFD, as it is not very clear.

Share financing is around 3%, which is quite clearly stated.

So I did a rough estimation.

From the daily emails they send, I pay around S$3.70 a day including currency conversion fee.

Multiply that by 365, I pay $1,351 a year.

My total position is around S$49,000.

So interest rate is around 2.7%.

Wednesday, December 2, 2020

Bought Salesforce

Salesforce dipped around 8% today.

Might be due to the news that Britain has approved the use of vaccine, and it can be used to treat people next week.

I always use Tableau, and it is a important skill to me.

My work efficiency increased many times, and also people in the company values people with that skill.

I used to own Tableau shares, and when Salesforce bought over it, I sold it.

Because of the valuation.

But my mind set has changed regarding valuation, especially for disrupting companies.

I bought it at $222, and will buy again if it dips to $200.

At least I am buying a company that I am familiar with the product.

And I believe it can take over Microsoft Excel, in terms of market share.

Excel is still useful, but more people will find Tableau more useful. But I still need Excel in my current work.

And recently Salesforce released the news that they bought Slack.

Not very sure about that software, though I have heard of it.

And few months ago, they bought Zoom, which I use it at work too.

For this purchase, it is not close to any support line.

So I used moving average to understand entry points.

Current price is at 150 MA.

Next Entry price will be at 200 MA, which is $200.

Wednesday, November 18, 2020

Last chance to buy Tesla?

Recently stock market has been raging upwards.

It is the moment I have been waiting for, for so long..

Trump was actually quite spot on.

He mentioned around early November we could get a vaccine.

And that was a mental timeline I had.

Even though there is still no distribution of vaccine, there were great announcements.

2 USA vaccines announced their products are 90% effective.

Anyway, back to Tesla.

It was just included in SNP500.

It might be the last chance I can buy it around this level.

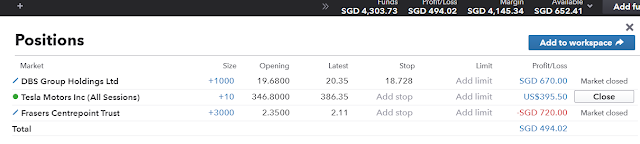

Friday, October 30, 2020

Closed Revolve

Closed out my revolve position just now.

Only had USD$36 profit.

It should be less than that when deducting the cost of 2 transaction fees.

Main reason for closing is to boost available funds.

Before closing, Available funds was at SG$60.

Now it is $652. Not really sure how that works.

But I read before that if you set a Stop Loss, you will have more available funds.

If your available funds becomes negative, they will give you some warnings and eventually sell your shares.

Maybe I should explore setting stop loss for my shares, at a price which I think it is highly unlikely to reach.

That way, I will be able to see how much the available funds change.

Another thing that I thought of just now. There should be less regrets selling shares now, as it will be a volatile period until the US election result is confirmed.

Which might be the end of next week.

There are fears that Trump will dispute the result if he loses, and the nation can plunge into chaos.

Thursday, September 24, 2020

Scared of China

I am scared of China

Their might, capability and their aggression.

One of my favourite way to allay the fear is to join them.

And investing in them is a good way.

But maybe not at the moment.

Maybe when price slid to the next support zone.

I am talking about ishares China ETF.

The share components look like those companies that I am fearful of.

Dominating and disrupting many businesses.

Below is their top components.

Currently the PE ratio is also not bad, at 16.

But being me, I always like to buy things at a discount.

So maybe nibble some at the next support around $65.

Friday, September 11, 2020

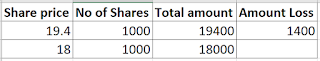

S$100 mistake

$100 down the basin, just like that.

calculated my position wrongly.

the $600 I saw when I placed 100 order is the margin requirement.

Did not do a simple calculation when buying ($18 x 100 = US$1.8k)

I think I was too tempted by the price drop and good valuation of the stock.

O well, life goes on, and a not too expensive lesson.

US$1.8k is larger than I would like to own

But it is still affordable for me. And 100 is a sweet number.

It is money that I have available and can just purchase it on TD Ameritrade.

But buying in IG allows me to use leverage, and use the money if there are other emergencies.

Bought another 100 Revolve

Just bought another 100 at $18.07, so I have 200 now.

Only having 100 is a bit insignificant, having 200 at least it is over $1k SGD.

And was watching Cramer, when his video was 1 year ago.

He said it was expensive then, and if it drops below $30, you can buy.

Currently the PS ratio is 2+, and PE is less than 40.

Looking at this stock, I find it more interesting than Lemonade.

Bought Revolve

Spent a small amount of money today to own some shares of this tech company.

Did not manage to go very deep into it, but heard of it from Matthew Huo and Jeremy.

Will be researching more about it after I made the purchase.

Got just 100 of it, spending around SGD 600+.

I has been bouncing away from SMA, and now is the exact moment it is at the 50 SMA.

Tuesday, September 8, 2020

Monday, August 3, 2020

Closed DBS positions

Tuesday, July 28, 2020

Lemonade goes down

Might be due to Goldman Sachs giving it a price target of $40

saying that the valuation doesn't add up

Glad that I stopped adding since owning 30 of it

maybe I will buy another 20 if it goes close to $50

also have to preserve cash

owning 30 shares of it is the cash I am able to pay for

but it is also cash for share financing buffer.

Thursday, July 23, 2020

Lemonade update

Lucky to buy it yesterday at $78

seems like price bounced off from there

now the consolidation pattern is even clearer

Wednesday, July 22, 2020

Another Lemonade

set the price at 78, before the lower band of consolidation pattern

Will be looking for the next price to enter again

maybe when it breaks out of the consolidation funnel

the next support zone is around 73

Monday, July 20, 2020

Bought lemonade again

Bought 10 at $86

Nice number

But the price came down to $84+

I am now watching more youtube videos on this company

seems quite interesting

like the part the founder talks about the complexity of insurance policy

and wants to make it easy

well that is real disruption

I will be using longer time charts from now on

maybe hourly

Bought this 10 shares as I felt having 10 is not that significant

now that I got 20, I feel more fed

and can afford to let price drop

if it goes up, at least I got 20

Friday, July 17, 2020

Chicken Genuis recommends

that aside, I am using Adam Khoo's way of visualizing

using a few levels of SMA

forming 5 parallel lines that clearly shows an uptrend

it is a easy way to know when to buy

when price dips to certain SMA, for example 100

then it is an opportunity to buy

Tuesday, July 14, 2020

1 more Capitaland

Today went to relook at it

and bought it at 2.86.

reason the price dipped was because they just paid dividend

they only pay once a year

they have a new CEO

with degree in Engineering

financial result is good for past 3 years

both revenue and net profit rising

dividend yield is around 4%

bought 1k of it

to make it total 3k, a more desirable number to own.

still like their business strategy

50% in Singapore, 50% in SEA and others.

Good quality blue chip to hold

Monday, July 6, 2020

Bought 2k AIMS

Did this after seeing many shares surging

and AIMs did not really follow

Price was 1.23

and using dividend of 10 cents

it is 8% dividend yield

just a small purchase

in case all prices keep going up

now both my OCBC and POEMs share financing have around $10k debt each

and each have 1000 shares of DBS

and they can withstand around a further 50% drop in the market.

I will be pumping $20k worth of shares into POEMs again

in case the market suffer another big plunge

Friday, July 3, 2020

Mental Overview

after many evening walks

calming my mind and thinking about investments

I made some mental targets

that if I have 230k of investments

before the full price recovery

I should be able to hit 300k before age 40 with a combination of recovery and growth

300k is decent, considering my target is to hit 500k by 45 yo

so now I would like to do some mental estimation

to see where I am at

ocbc share financing - 30k

poems share financing - 30k

cdp - 50k

dbs share financing - 60k

IG CFD - 40k

so total is 210k,

which is pretty good

I should not force or rush the target of 230k

even if it means that the market recovers and I do not buy again

some distance away from the target can act as a buffer

in case the market has a bad crash again.

If there is no chance to buy again, I should be happy and contented with what I bought

having some buffer is good

it is like still having bullets

to eat some if the market plunge further again

Thursday, July 2, 2020

More capitamall

Bought it at $2 per share, 4000 units

Total units now is 12,000 units

Aiming for 15k or 20k units

If price goes down more

The next support zone is around 1.85 (using monthly candles)

Most likely will be transferring more shares into Peoms account

Make better use of those dormant shares in my CDP

But also have to ensure that I do not be overly-aggressive

and lost everything if there is a crazy crash

I am hoping the share financing will be able to withstand a crash of 50-60%

Monday, June 29, 2020

Thinking about Capitamall now

to make it a nice number of 8000 shares.

Buy when it is on a dip

and it is approaching the support of 1.9

I was thinking of shifting my focus on Capitamall

Instead of accumulating DBS

recently, there were many topics about the new digital banking license

and I feel that I have shown enough love for DBS for now

depending on whether the markets continue to dip

if it is low enough, I might start going aggressive on CMT

it is similar to DBS, just that DBS price is 10 times more

DBS is now around $20, and capitamall is around $2

Thursday, June 4, 2020

Bought HK land

now I have 2k worth of their shares

decided mainly because I think it is not likely US and China will split the world into 2.

For all the rhetoric, they will sit down on a table and work something out in the end.

Even if the worst does happen, at least there is still strong revenue from China and SEA.

HK land current valuation is also very good

PB ratio at 0.25, dividend yield at around 5%.

Very good debt ratio of less than 10%.

Dividend payout ratio is also around Capitaland, which is 30%.

Also they recently purchased a very big prime plot of land in Shanghai

So their properties now are equally diversified between SEA, HK and China.

I bought it with DBS share financing.

It might be less conversative than I wanted.

But hopefully my other shares arrive into the account quicker.

maybe I will top up some cash in the coming months.

If my calculation is not wrong, I can survive a 30% dip, but not a 50% one.

That is valuation about 1 mth ago.

Hopefully I can get it to around 50%.

Wednesday, June 3, 2020

Hong Kong Land thoughts

Wanting to have more of it, but might not

USA removing the special status of Hong Kong will have an impact

Many are saying that USA will not, as it will damage them financially too

but US may want the world to decouple from China

And naturally Hong Kong will also be ignored

and would not mind letting it go into ruination

With China acting strong now, and US being aggressive since Trump

Things might just go that way

US will not mind having some economic damages

If both nations are acting tough, HK will just suffer.

But then again, the leader of China is XJP, not those wolf warriors

at the end of the day, he will use his clear mind to strategize and negotiate

So maybe I can still invest in HKL, by having faith in XJP

Tuesday, June 2, 2020

DBS has moved

Was very lucky, accumulated the number of DBS shares I wanted with CFD

which is 2k of shares. And with that, I have a total of 5000 DBS shares

I just need to pay of this 2k of DBS shares off

which is around 40k

But it is better to invest early than to invest on dips

Was apprehensive at first

after listening to a youtube channel that mentioned about Wedge price action

and the chart is showing a bearish wedge pattern

the resistance is at $20

and the lows have been increasing upwards

the logic is that the resistant is very strong at 20

when it is closer to the sharp point, it will collapse

Lucky I did not strictly adhere to the logic and bought with fundamental thinking

and also knowing that price below 20 is a very good price

I am also looking at Hong Kong Land now

still not really decided on it

the DBS shares is not a done deal, and hopefully it continue upwards with strength

Monday, June 1, 2020

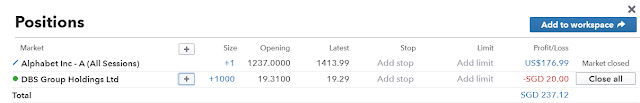

Another 1k DBS

Price is at $19.68

Which I think it fair considering the long term

I am more afraid of the share suddenly surging

and breaking the resistance line at $20.

now I can only hope that it does not go to $17.5

if not, I will lose $4k SGD

Some thoughts about why I bought

US banks have rallied, and Singapore banks may follow soon

SnP 500 do not look like slowing down

and broke another resistant zone recently.

Singapore REITs surged last Friday

and I was afraid they will turn attention to bank stocks soon

as DBS price below $20 is really very good

Monday, May 25, 2020

New discovery to hedge

cause I wanted to buy DBS shares

With share financing

But both Poems and OCBC are taking very long to open account

The way to hedge it to take a position with CFD

using my IG account, which was there all along

It really eases the anxiety,

when I am not sure when I can get my new accounts

and also fearful that the share price will go up

currently, DBS shares is below 20

it is a great price, as it has dividend yield more than 6%

and that is based on the old dividends

moving forwards, dividends may increase to 1.33

which will bring dividend yield to 7.3%

Later in the day, Singapore government will announce another stimulus package

Called Fortitude

Not sure how much will it cause DBS to rise

I am hoping to buy another 1000 DBS shares on CFD

as I hope to own 5k DBS shares coming out of the crisis.

Coincidentally, today is supposed to be the day we receive DBS dividends

Hopefully I am getting 2k if I am not wrong

Once I see it in my account, I might pump that money into IG again

and buy the other 1000 DBS CFD

Also did some stress testing on the CFD positions

The 1000 DBS shares that I buy,

if it falls to $18, it will incur a loss of $1400.

And good thing is it will not be margin called yet.

Maybe it is a good thing that I only have limited funds in IG account

It can be an auto stop loss

But to me, it may not be very likely

The price seems quite stable now

The SNP 500 is starting to breaking the resistance zone of 2975

So what does this have to do with the share financing account?

When the share financing account is set up, I will buy 500 shares each in Poems and OCBC

and every time I buy 500 shares, I will sell 500 shares in IG

So in a way, I am using the CFD positions as a hedge in case the price rise in future.

Friday, May 22, 2020

Nibbled Cromwell Reit

with Poems and OCBC

Using them because I want to use DBS shares as a collateral

and buy more DBS shares

To make myself feel a bit better

I bought a bit of Cromwell

After reading their Q1 report

Looks good

I think this is a first time I describe my purchase as nibble

only spent around 2k SGD

and it is done using share financing with DBS

will transfer 4k more worth of shares into that account

when times are good like now

when things are on discount

it is good to buy periodically

maybe fortnightly.

Monday, May 4, 2020

Mental stress test

To open securities account

and also tried signing up for Peoms

Both for share financing

Peoms is surprisingly easy to sign up

but i had fear about put my biggest counter outside of CDP

but thought that it is a gd idea to put 1k shares in each for collateral

hopefully by the time they are set up, DBS is still at a good price

also did some mental stress test

and realization

that my DBS share financing account

should hold on about purchasing more shares

wanted to buy 500 OCBC today

as they have a lower non-interest income

which will not be affected so much by interest rate cut

so the calculation of the stress test

i injected 23k worth of shares into the dbs share financing

i bought 15k shares (capitamall, Cromwell, Aims)

but 5k (cromwell) is not marginable

the main thing is you have to imagine when shares fall 50%

less likely especially now that shares have already fallen 20%

but peace of mind is more important

so 23k + 10k = 33k (total asset value)

33k / = 16.5k (another crisis hit, 50% drop)

16.5k / 15k = 110%, which is lower than 140%

and will trigger a margin call

I need 21k as the nominator, which is 4.5k extra

but it can be solved by adding cash funds

50% drop is unlikely at this moment

but it is always good to prepare mentally

Thursday, April 30, 2020

Bought Cromwell last min

Wednesday, April 29, 2020

Panic last night again

Was eager to buy more shares

same lots as I bought on Monday

Capitamall and Aims

Got them at 1.75 and 1.16 respectively

Was glad I bought, Capitamall rose to 1.8

I wanted to buy more as I saw that US market keeps raging upwards

Singapore market seems to be lagging behind

so there are still opportunities to buy

Also saw the DBS share financing example (below)

even if dividend of 6% is considered decent

so even if capitamall div yield drop to around 6.8%, it is still nice

and also grew some liking for Capitamall

many of the malls I felt happy going

Like Junction 8, Tampines Mall

they are heartland malls the footfall is good

I am happy that I have a piece of it,

and feels good everytime I visit them.

hopefully I can manage to get more

currently I have 7000 of it in the share financing account

also thought about it today

that instead of borrowing more personal loan

I should just use my share financing account instead

I wanted to use more personal loan initially,

as the share financing account is unable to buy dbs shares

but I can just get uob or ocbc

also a good way to diversify

I already have 3000 DBS, a nice number

the interest rate is also better, at 3%.

personal loan is 10% or more

if there is margin call needed

I will just take up personal loan to buffer

Monday, April 27, 2020

Panic over Sunday

Was a little nervous yesterday, and had less sleep than usual

But this morning managed to buy what I wanted

Surprisingly, I could place order around 2 mins before the market opens

throughout the day, most of the shares rise

not sure if I have other opportunities to buy again

But might buy even when they are rising

I have a target to have 150k worth of shares before the market recovers

and when it recovers, there is a good chance for them to become 200k

a very decent milestone for me

for now, I have around 35k more to invest if I am aiming for 150k.

and these are on borrowed funds

carefully

but this is a very rare opportunity

so I am also worried about not having a job

but I need to take this chance

and if I need to work, I might do work as a food deliverer

Saturday, April 25, 2020

Share financing is here

Is uneasy as I am not able to place trades now

Payment with Share Financing cannot place trade when market is not opened

Target price for Aims is 1.18, and 1.73 for Capitamall

The Capitamall price will still give me 7% dividends

If the purchase is successful, I will have 5k of Capitamall, and 8k of Aims.

Total spending will be around 5k.

I have to leave some space for future trades.

Wednesday, April 15, 2020

Not sticking to rules, but to goal

quite unlike me, as it was going upwards

but I was keeping my eyes at my goal

of buying more investments now

I thought that

the good value is $25

and even at $20, it is even better

I was thinking of getting 500 shares initially

but found a compromise to buy less, 300 of it

if it goes down, I will add on more

why did I wanted 500 at first?

so that it is a nicer number

which is 2.5k DBS shares

also bought 1 Goog using IG today

not really sure about it

but I also wanted it to be long time

to own 8 Goog shares

currently I only have 5 in TD account

only can afford to get 1 in IG account

Tuesday, April 7, 2020

Milestone Hope

which is SGD $100k in Singapore shares

bought 300 DBS and 3000 capitamall yesterday

was glad I bought it

as stocks went up around 7% today

don't know about the future

it might go back down

but currently I am more afraid of not being able to buy

than the stocks crashing again

but the words from Adam Khoo is very logical to me

the markets is rigged to be bullish (QE, interest rate, etc)

there is another chance to buy

which coincides when i get my bonus

which is around 12 Apr

if I spend another 10k

then it will be around $100k of Singapore shares

I take a long term view

whatever happens to the stock market

i am still buying during a time when shares are cheap

DBS is valued good around 25 to be

even if I get it at 20, it is still good

Sunday, April 5, 2020

Adjusted Capitamall

I changed it to 1.6

Usually I also try to set the price at a lucky number

like 18

now the prob is whether I will be able to get the shares

Decision time

should i place order this weekend

for 2 shares

many factors spurring the thought

one strong one was watching Adam Khoo video

about the market bottoming

"the market is rigged to rise"

QE printing, and other government supports

also kept seeing quite a lot of good news

possibility of vaccine soon

today Singapore gov announcing 3rd package

Europe curve is flattening, and possibility of partial opening of lockdown

also if I place order now

even if the market is down

because it is a limit order

I will still get it at the best price

I have the advantage as I set it at a high price

I get the best of both worlds

low price I get, if rise, I also get it

just that the prob is, how high I want to set

another factor was also a calculation I did

if I get it at the price I want to enter

I get it at SGD $400 cheaper.

but the thing is, is the $400 that big?

especially when the crisis is over

$400 is really nothing that much

so what are my orders?

300 of DBS @ $18

3000 of Capitamall @ $1.55

the 2nd order, I am still pondering if I should put it at 1.58 or 1.6

I still have 40 mins to meditate on it before market opens

Simi is stochastic

The link below is a good video to exmplain

https://www.youtube.com/watch?v=SrCENnDVHRk

The formula is below

Saturday, April 4, 2020

Adam Khoo release

https://www.youtube.com/watch?v=zf26u-2I1yE

very interesting and scientific

made me want to panic buy now

he used 2 indicators

ATR and Williams R

ATR has to be more than 80%, Williams R below 80%

When stocks crash, the range is always wide

ATR 80% means range is wide

Williams R shows when shares oversold

Below 80% means oversold

when these 2 coincides, we are close to bottom

remember stock market is always leading indicator

it is not the economy

usually stock market becomes bullish 6-9 mths before the economy recovers

This is the current situation above

I am thinking of adding DBS @ 18, and Capitamall @ around 1.55

Monday, March 30, 2020

Bye China shares

Sold the remaining BABA and TCHEY shares

part of the reason was because they did not dip as much as the American shares

Managed to get 4.3k USD from it

and add it to boost my war chest

another reason was also because

of reading some blogger liquidating US shares during this rally upwards

also seem like many stock veterans are still not going all in yet

so i might as well increase my war chest

in case they are right

this Great Singapore shares sale might be once in a decade

so it is better to be more prepared for it

my next move, if it comes

will be to get DBS at around the previous level that I got it

around 17, or even lower

because it might be a support zone

it might bounce back up and never come back again

so i might as well get 300 more, and I will have total 2000 dbs shares

take it as using these China shares to exchange for DBS @ $17

then the next level for dbs is around 13, and I am aiming for 500 of it

also applied for DBS share financing today

which I cannot use it to buy DBS

so that share financing will be used for buying other shares

like AIMS, Cromwell, First, etc.

I do not have alot of money

but there was a nice saying I learnt

while watching Chicken Genius youtube channel

he mentioned that Anthony Robbins said this before

it is not that you don't have resources,

it is just that you don't have the resourcefulness

my need to get money for this once in a decade chance has made me consider many options

share financing, borrowing from my wife and my joint account, personal loans, liquidating US shares, etc

all because I think about having passive income from shares on my bed every night.

Monday, March 23, 2020

Bought Cromwell and DBS

but i should learn not to do that

if the price is close, it is good enough.

i wanted dbs at 16.8, bought at 17.03

wanted cromwell at 0.28, bought at 0.3

i was feeling alot of frustration and anxiety

it was not worth it.

for the price i got them, it costed around $200.

this is small money

below are target price of next wave purchase

dbs around 12-13, 500 shares

cromwell around 0.2, 5k shares

capitaland around 2

first reits around 0.5 (which is now)

aimsapac around 0.7-0.8

hongkong land around 3

capitamall around 1.2-1.3

Thursday, March 19, 2020

Plans

Was thinking of the stock market

Hope the week will be lower

Some thoughts about how I can buy

Dbs around 16.5, buy 300, ard $5k

Dbs ard 12-13, buy

Aims ard 0.8, buy

First REIT, and 0.37, buy

Cromwell ard 0.28, buy

Frustration and new logic

Monday, March 16, 2020

Sold remaining Apple

Was thinking when brushing teeth

That I still had some expenses

2k of credit card bill

1k to pay in Apr for condo payment

Remaining 10% to pay for condo Reno

Which is around 1k

Looking at hourly candle sticks

Apple is also bouncing up towards the 50 sma line

So I'm bearish trend, it should come down

I also did not lose money on Apple

As I bought it cheaply

If this market crash is one chance in 10 years

I better make better use of it

By grabbing whatever funds I can get

Also, I do not like Apple anymore, after the trouble they caused me when transferring USA photos

Not looking to sell China shares

The only one that I think I might release some funds might be Facebook,

If the markets suddenly have a short rally

Very bloody

Wrote about selling strategy few blogs ago

But well, life is like that

I am contented that I liquidated quite a few when the markets are bloated

Had been on shopping spree past weeks

Some DBS, and 10k of Cromwell

Like what was mentioned in the previous post

Hope this beautiful bear is just starting

Many experts say it may last 1 year

And the worst is not here yet

I still have bullets from different source

Looking forward to eating more

below are some prices I am looking forward to

DBS around 17 per share

Aims apac around 1.05 per share

Some others are HK land, Cromwell, capitaland

not limited to these

there are Sales sign hanging everywhere

Friday, March 6, 2020

Beautiful Bear

I am eyeing more DBS shares

maybe 2 more around 22

another 2 more also around 22

then 2 more at 17 (2013 support, Daily candles)

and another 2 more around 15 (2011 and 2012 support, Daily candles)

Thursday, March 5, 2020

Heart DBS

One at around 25, another at around 24

Love this stock, the PE is around 10 now

and also div yield around 5%

which is so good compared to REITS

that those quality ones are below 5%

will try to hold my bullets and wait for the price to hover near 20

I bought because this might be a small opportunity of window

if the corona virus clears, it might go back up again

and also, if I do not add periodically, I may not have a sizable amount of share

Friday, February 21, 2020

Army and re-evaluation

It will be quite sad as it will be the last time

People that you knew during the past 13 years will not be obligated to meet again

Learnt a lot from the people and my time there

Realized that almost all of them do not invest

Even though they like the idea

But mainly it was because they did not have the interest

to understand companies and investing

I felt that I am quite fortunate

I had the interest, and had less obligations, and also had some prudence

many also had to support their parents

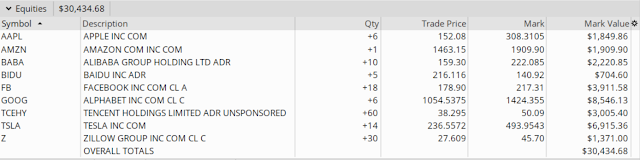

was also looking at my portfolio

and trying to find some direction

I took the top down approach

My account had expanded, from the time I invested 40k SGD into the account

Today it is worth 46k USD

During this time of expansion, I thought that I should have around 20k USD of cash

To feed my warchest

Currently my cash is around 14k USD (below)

So I need around to liquidated around 6k USD of shares

The next step will be to look at the breakdown of my portfolio.

Which of the shares do I want to reduce or sell off?

Some of the consideration include :

Are they around the highest resistance zone?

And which are the stocks I really love and want to hold some of it?

What is their PE?

Proportion of value in portfolio

Amazon is a stay, as I only have 1 of it.

Their blue origin business also looks nice, even though it looks like a penis.

Philosophy is clear and simple too.

But it might not be part of the company

Selling of shares is not an easy question to answer

But it should be asked,

as this account should serve a bigger picture

to deflate the account when it is on the high

if not, when the market slides, it will be late

better to deflate a portion of it first

after some pondering about which holdings to reduce or sell

firstly is Apple, all 3 of them

starting to dislike them

and they do not seem to have very huge innovation

and they have been on a rally for quite long

reaching PE of 25

Also might sell another 2 Tesla

and 6 shares of Facebook (PE of 33)

For baba (PE of 25) and Tencent, might want to keep them

to ride on China's rise

Google is my favorite stock, might want to keep all 5

their PE is at 30 now

But if their price rises to another level, might let go of another 1

For Baidu, their revenue and profits are still growing YOY

and they have dropped to around half of what I paid for

Will hold them as selling them will not make much difference in my account

For Zillow, might want to sell 10 of it, as it is now at the highest resistance level

But all these above might not be able to give me 20k of USD cash

But it is good that I set a target of 20k USD

And might make different decisions along the way

More importantly is to have a target.

On another note, found out that one of my platoon mate is making money full-time from Forex trading

Very interesting as I finally know someone that proved that it can work

Might be exploring the idea again

Thursday, February 13, 2020

Wah lua Apple, slash half of you

Wednesday, February 5, 2020

Tesla drop and Zillow sale

It is close to a support zone

Good to load up on cash.

I bought Zillow when it was around 27 USD.

Currently I have 13.7k USD in cash.

It can be part of a war chest for Singapore dividend shares.

Which is for passive income.

Tesla dropped to USD 760 per share currently.

It is good I sold 1 share yesterday.

Tuesday, February 4, 2020

Another Tesla sold

Which is after a $200 jump rather than $100 jump.

Sold 1 Tesla share @ $892 just now.

Now I am left with 11 shares.

One interesting video I watched just now is about when to sell.

The video mentions to look at market cap.

So if you think if Tesla will be worth $500 billion soon,

then wait until then to sell some shares.

Currently the market cap is around $163 billion.

Naturally, there should be more resistance when it closes in on $1000 per share.

As it is a nice whole number.

Monday, February 3, 2020

Sold another Tesla

Now I am left with 12.

Might need to slow down the selling

May decide to sell at 200 intervals

Meaning to sell when it reaches 900 USD per share.

Wednesday, January 22, 2020

Sold 1 Goog

Intention was to cash out 1 when it is closer to 1.5k per share.

Now I am left with 5 more.

Tesla has been hopping upwards nowadays.

The next sale will be when it is close to 600 per share.

My total account now is worth around 41k USD.

Interesting time.

First time I am experiencing a bullish run.

Seeing good and green results in US shares frequently.

Enjoying the activities in my USD account.

Keep a balance between converting shares into cash,

and also safe keeping some for value investing.

I am heading to USA this Friday 2 am flight with Qatar.

Should be a good adventure, and hope every goes well.

:)

Thursday, January 9, 2020

Sold another Tesla, 14 left

As it is reaching 500, I sold another Tesla.

Stock market is surging again.

My USD account is currently US40k.

But if your account increases, and you do not convert some to cash,

it is not that meaningful as it will go down again.

I have 9.6k USD in cash in the account at the moment.

good to load up on bullets during this bullish party.

Tuesday, January 7, 2020

Sold 1 Tesla

But at the same time, I am not unreasonable to sell 1 share.

I still have 15 left.

Next price to watch should be around 500.

And when it reaches 500, it is around price target of analyst.

And if I am still left with many shares then, when do I sell?

So therefore, I decided to let go of 1 today.

Stocks have been surging, and today I have USD 39k in the USD account.

Google was also surging, to close to 1.4k per share.

But because I do not have many shares of it left

around 6 of it,

I might let go of 1 if the price goes close to 1.5k per share.